Fixed returns from 6.00% p.a.

Earn income with property-backed investments structured to provide regular returns.

Benefits

Unlock the Power of Peer-to-Peer Lending

Peer-to-peer lending gives investors the chance to step into a growing asset class with real advantages over traditional fixed income investments. By connecting lenders directly with borrowers, you unlock opportunities that are transparent, flexible, and rewarding.

The only investing product you need

Choose how you want to earn interest

Peer-to-peer lending

For investors looking to earn higher returns through first mortgage–backed opportunities.

On-call account

For investors seeking flexibility and quick access.

The only investing product you need

Start investing with three simple steps

Create your free account

Sign up online in minutes and verify your details to access the Go Lend platform.

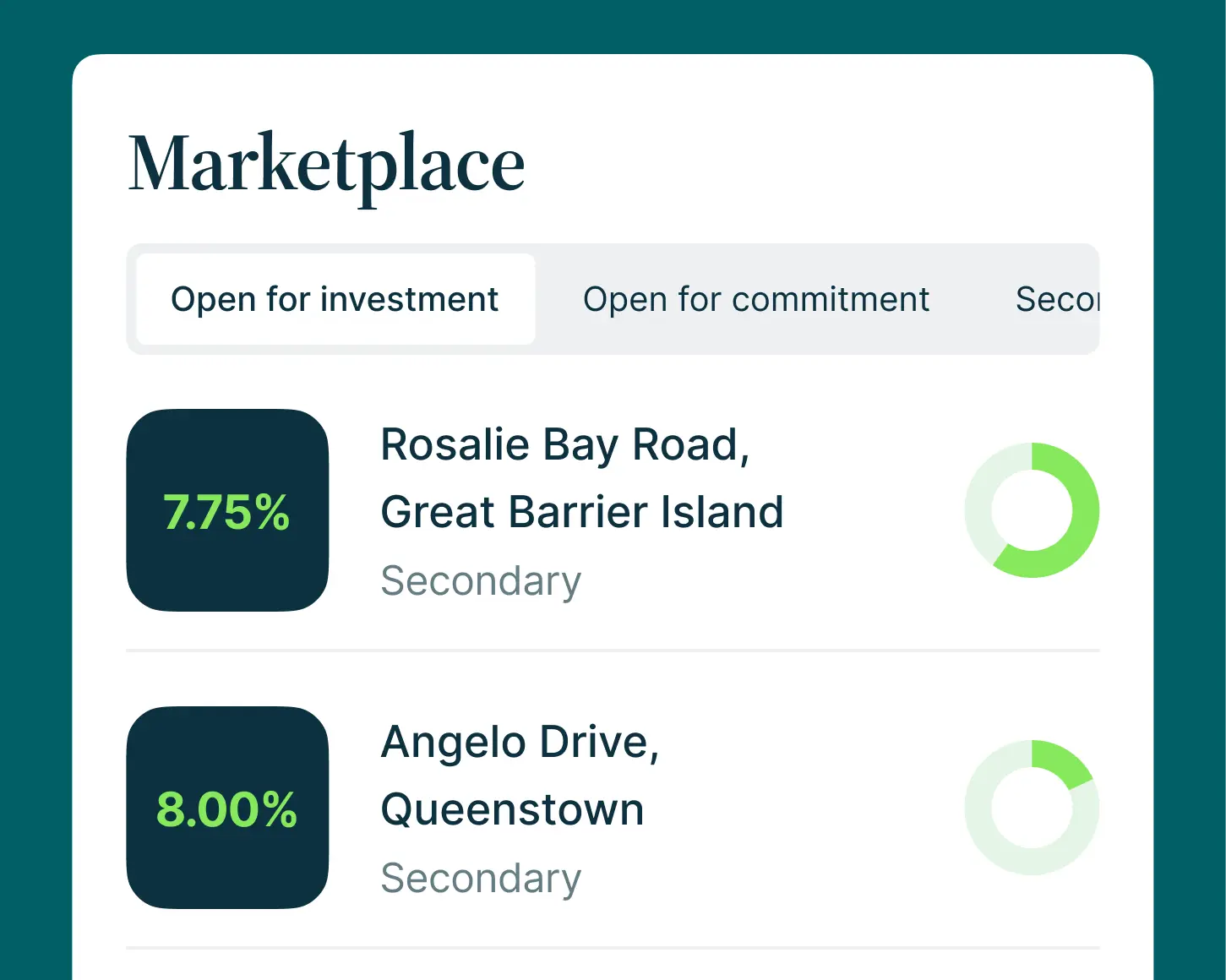

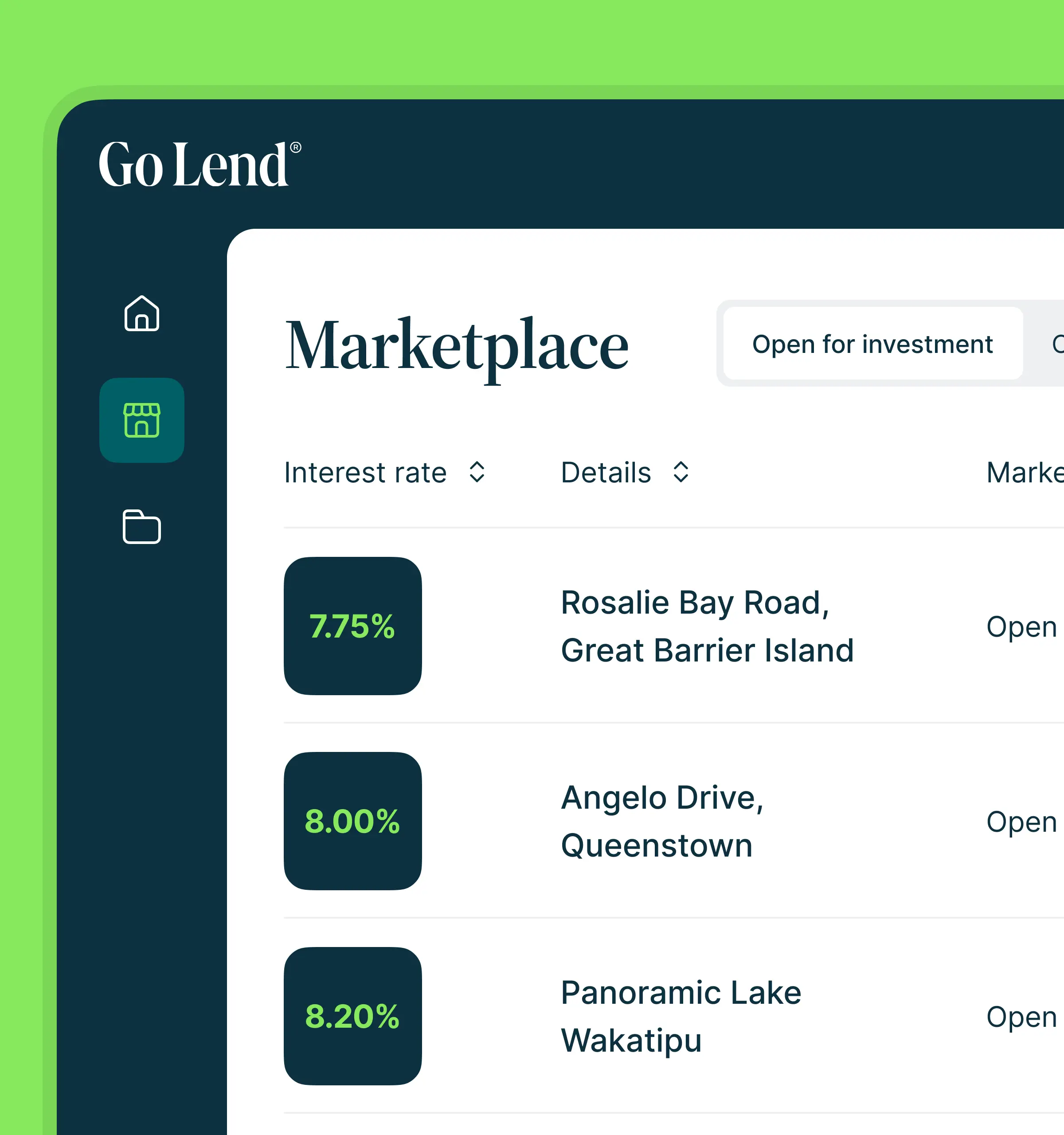

Browse opportunities

Explore a range of property-backed loans and choose the ones that fit your goals.

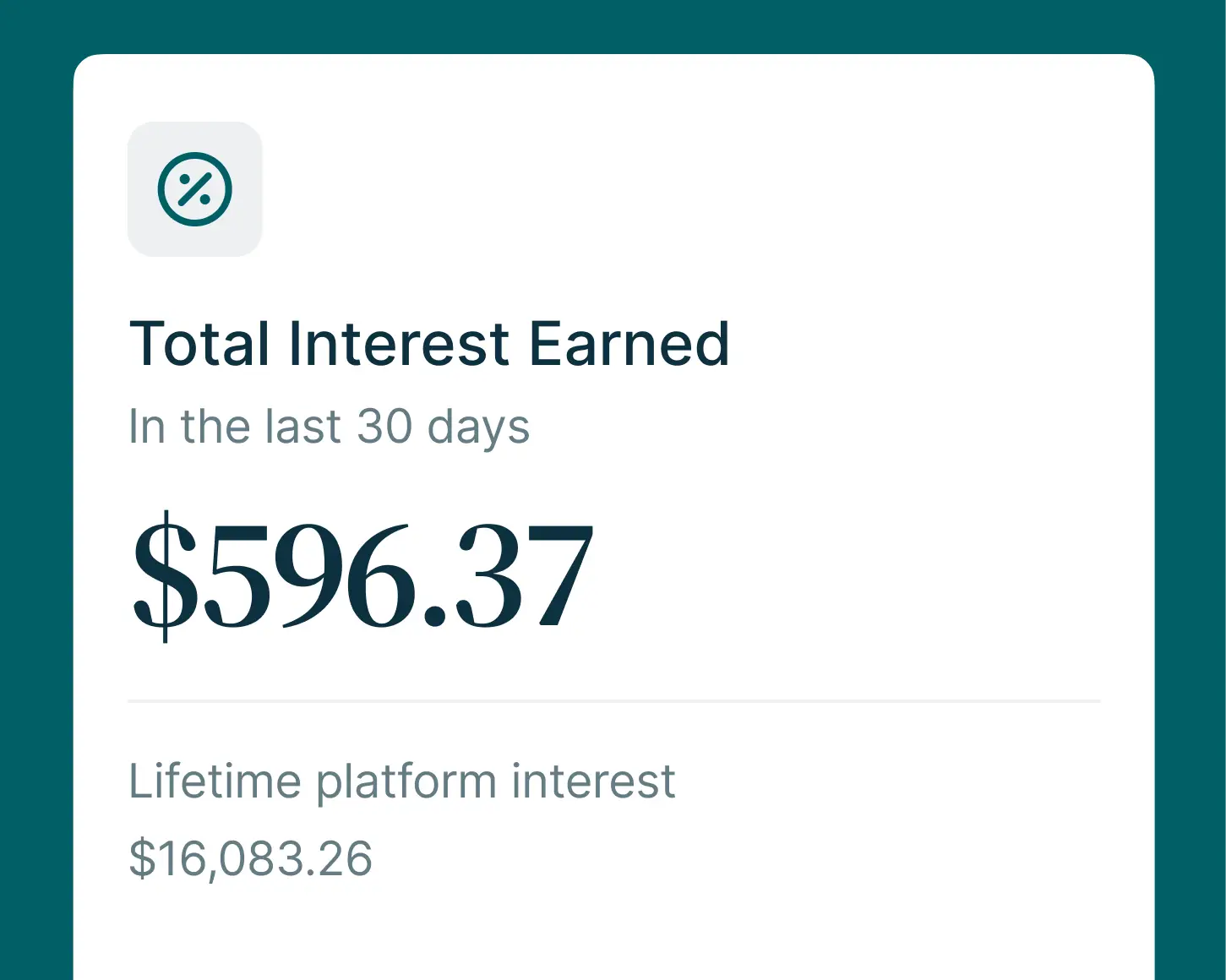

Start earning fixed returns

Put your money to work and receive monthly interest payments on your investments.

Go Lend Platform

Where Simplicity Meets Opportunity

Go Lend makes investing straightforward and stress-free. Our platform is designed to give you clarity and control, so you can focus on growing your money without the complexity of traditional investing.

Why Go Lend?

“Great communication from the team, great rates and easy to use website.”

FAQs

P2P is a marketplace that matches those with a borrowing need with those with a desire to invest. The Go Lend P2P platform is dedicated marketplace for P2P loan opportunities that are secured by registered mortgages over land.

All investments come with a degree of risk. Lending opportunities are assessed against risks factors including:

- The risk of default – This is the risk that a borrower fails to make their regular payments.

With a borrower's consent, the platform will disclose the enquires made to assesses a borrower's ability to make their regular interest payments, which can then be considered by any potential investor.

In many cases the decision will be made by the platform to retain sufficient loan proceeds from the borrower to adequately fund their loan payments over the contracted term of the loan. This mitigates the risk of default for investors during the agreed loan term.

- The risk of loss – This is the risk that a borrower is unable to fully repay the loan advance.

All Go Lend loans are secured by way of mortgage over the security property, which is held in trust on behalf of the investor. We try to manage and resolve issues with a borrower as quickly as possible. If needed, default interest is applied, or the property is sold to recover funds. All of these steps are communicated to investors, so you know what is happening.

The Go Lend staff have vast experience, spanning many decades, in managing property backed loans. We try to manage and resolve issues with the borrower as quickly as possible. If needed in the event of a borrower's default on their loan, default interest can be applied, or the secured property can be sold to recover funds. All of these steps are communicated to investors, so you know what is happening.

We also have loans that are serviced by Prepaid Interest. This is where we hold the interest required to service the loan in a trust account for the borrower. We control the interest payments, reducing the risk that the borrower doesn’t make a payment. We will let you know whether a lending opportunity is serviced by Prepaid Interest, before you commit.

Unlike typical managed funds, Go Lend as a peer-to-peer platform provides investors with control and choice over the exact lending opportunities they invest into.

Go Lend manages the entire process. Go Lend assesses each loan opportunity then contributes the initial funding of all loans that meet our assessment criteria. This means that if, for whatever reason, investors do not choose a particular opportunity, then Go Lend is happy to stay funding the loan throughout its entire term. We believe this gives investors additional faith that we are comfortable putting our own funds into every loan opportunity we present. Go Lend then manage each loan, monitoring loan payments and distributing to the relevant investors, and facilitating the full repayment at loan maturity time.

The lender of record is GLG Trustees Limited. This entity holds both the mortgage securities over the borrowers' properties and the loans themselves in trust for whichever investors own each loan opportunity. The trust keeps a register of who owns which loan, the supporting security, and any additional funds held in the trust account. Whilst Go Lend manages the platform and oversees the loan during its lifecycle, Go Lend has no claim or rights to investors' trust funds or mortgages – the trust (GLG Trustees Limited as trustee) holds all funds and mortgages for the sole benefit of the investors.